36+ mortgage debt to income ratio limit

Web Your maximum for all debt payments at 36 percent should come to no more than 2160 per month 6000 x 036 2160. Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis.

Proptech Switzerland Innovation Index 2021 By Proptech Switzerland Issuu

Apply Now To Enjoy Great Service.

. To figure out your DTI add up your monthly bills such as. Ad Highest Satisfaction for Mortgage Origination. Ad See how much house you can afford.

Web Calculating your debt-to-income ratio DTI measures your debts as a percentage of your income. To calculate your debt-to-income ratio first add up your monthly bills such as rent or monthly mortgage payments. The rule says that no more than 28 of your gross monthly income.

Web How to Calculate Debt-to-Income Ratio. DTI is 36 to 42. Web If your income is 4000 the math looks like this.

Web Your monthly debt payments would be as follows. Heres how lenders typically view DTI. You shouldnt have trouble accessing new lines of credit.

Well Help You Compare Loans Get Started Today. Estimate your monthly mortgage payment. Web Lenders calculate your debt-to-income ratio by using these steps.

Web Here are debt-to-income requirements by loan type. Web In January 2023 FHFA announced redesigned and recalibrated grids for upfront fees in addition to a new upfront fee for certain borrowers with a debt-to-income. Web Most traditional lenders require a maximum household expense-to-income ratio of 28 and a maximum total debt to income ratio of 36 for loan approval.

Web 45000 36 16200 allowed for housing expense plus recurring debt. According to the 2836 rule your total monthly debt should be no more than 1440. 1 Add up the amount you pay each month for debt and recurring financial obligations such as credit cards car.

Gross Income of 3750 4500012 3750 28 1050 allowed for. Web Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money. If your home is highly energy-efficient.

Web Lenders use your debt-to-income DTI ratio to assess whether you can afford the monthly payments on the mortgage youre applying for. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Your debt is likely manageable relative to your income.

Web Debt-to-Income Ratio DTI In general mortgage lenders like to see a DTI ratio of no more than 36. Youll usually need a back-end DTI ratio of 43 or less. In reality however depending on your.

1200 400 400 2000 If your gross income for the month is 6000 your debt-to-income ratio would. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Apply Online Get Pre-Approved Today.

Web The 2836 DTI ratio is based on gross income and it may not include all of your expenses. Ad Compare Best Mortgage Lenders 2023. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43.

4000 x 036 1440. Web DTI is less than 36.

Mortgage Calculating Debt To Income Ratio Using Property Income Debt

What Is The 28 36 Rule Money

:max_bytes(150000):strip_icc()/MortgageRates_whyframestudio-6aa583d504f34e758a2b63f052308838.jpg)

Too Much Debt For A Mortgage

How To Get A Mortgage Home Loan Tips

Debt To Income Ratio Requirements And Factors That Influence It

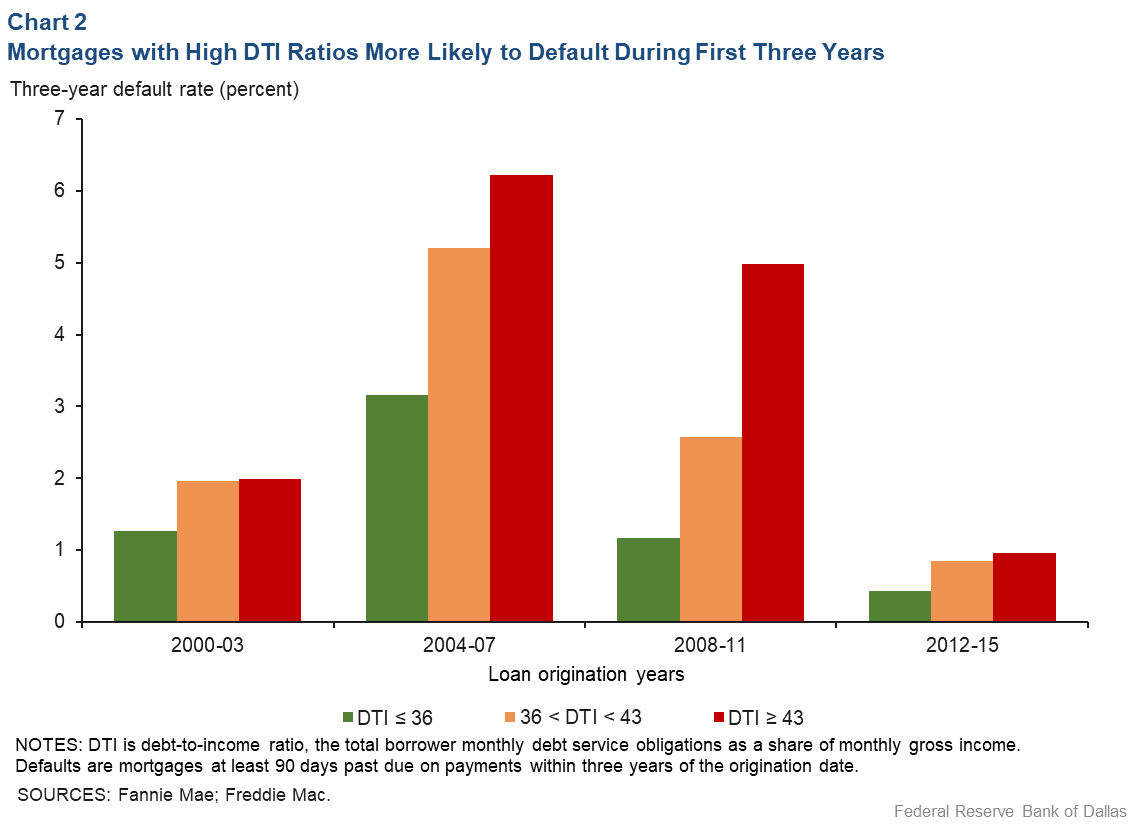

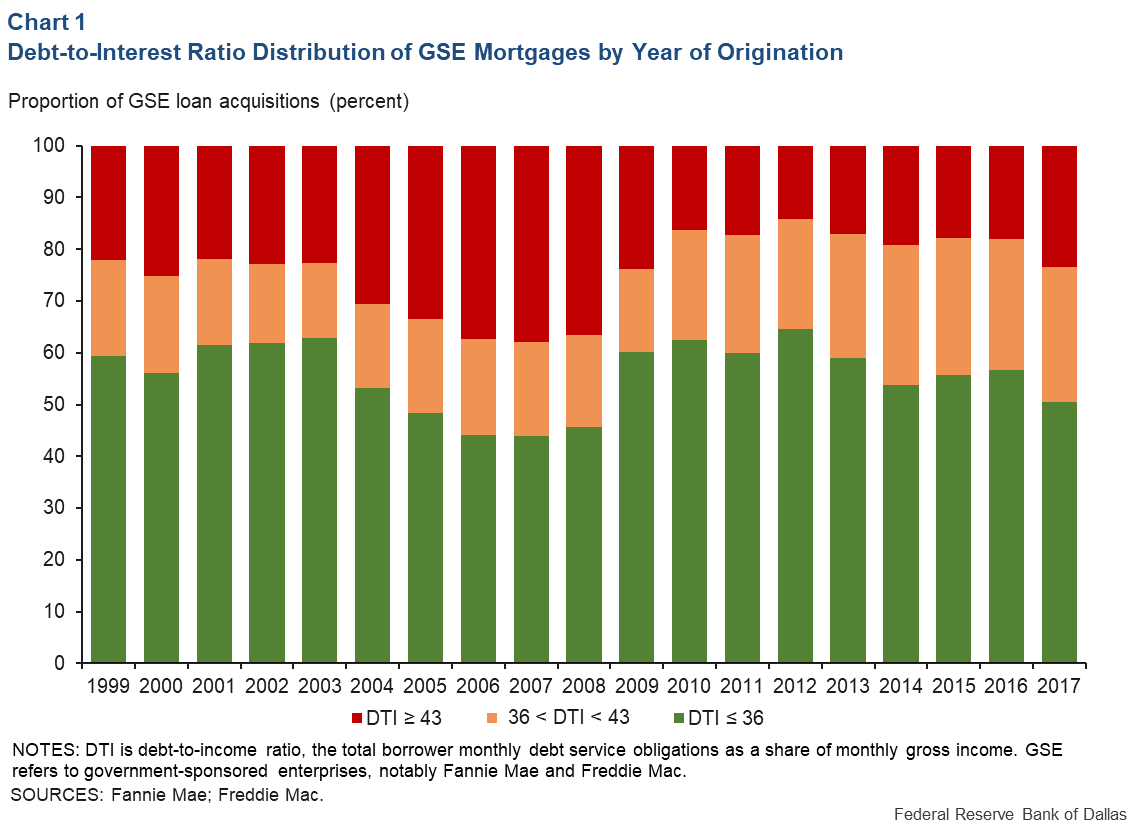

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

What Is The 28 36 Rule Practical Credit

Why Mortgage Applications Get Rejected What To Do Next

What Is The Debt To Income Ratio Learn More Citizens Bank

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Fannie Mae Debt To Income Ratio Limit Increase Credit Karma

Calculated Risk Hamp Debt To Income Ratios Of Permanent Mods

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

Socio Economic Impacts Of The Covid 19 Pandemic On New Mothers And Associations With Psychosocial Wellbeing Findings From The Uk Covid 19 New Mum Online Observational Study May 2020 June 2021 Plos Global Public Health

What Is The 28 36 Rule And How Does It Affect My Mortgage The Motley Fool

How Your Debt To Income Ratio Can Affect Your Mortgage

What Is The Best Debt To Income Ratio For A Mortgage Bankrate